SavingMatters

FPC Online – SavingMatters is Financial Planning Concepts online system that allows you to access tax efficient investment products, quickly, easily and of course online.

We offer a complete guided service to help you find the right investment portfolio for you.

Minimum regular payments from £100 per month and one off payments from £1,000.

- Low initial fee

- ISA and General Investment Accounts (GIA) available

- Individually tailored investment portfolio and strategy report provided online

The simple online risk profile and straightforward suitability questionnaire establish the most appropriate investment portfolio for you.

Once completed, details of the asset allocation and individual funds will be included in your personalised investment report, along with all costs involved.

We will also provide a suitability report and secure access details providing online access to your account 24/7.

Our online risk and capacity for loss questionnaires have been scientifically designed by Parmenion and Edgecumbe Consulting.

We measure your financial risk tolerance (how risk averse or risk seeking you are), and risk capacity (how much you are likely to be willing to put at risk).

The tool generates a report which shows scores for risk tolerance and risk capacity, and an overall recommendation for the risk grade; this in turn helps guide you to the most appropriate investment portfolio.

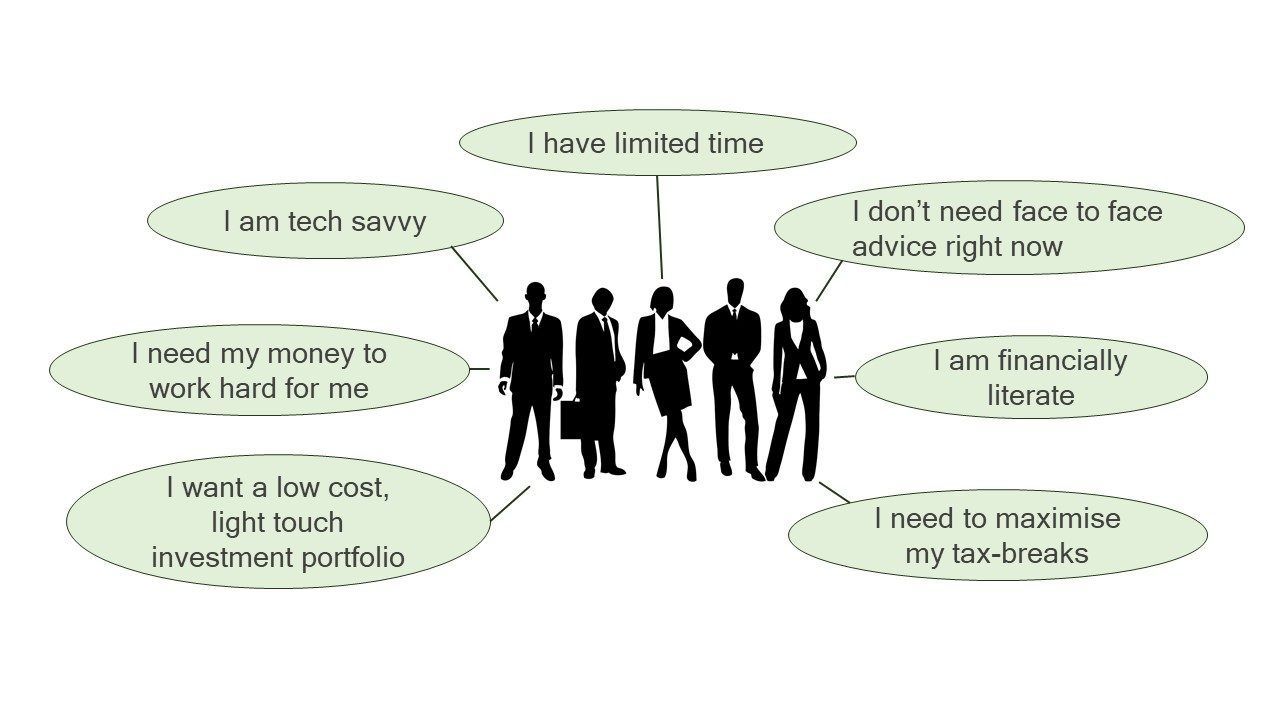

I have limited time

- Our process will normally take about ten minutes to complete

I’m tech savvy

- You’re comfortable using online tools and systems

I need my money to work hard for me

- You’re busy working hard earning money and need to get the best returns you can

I want a low cost, light touch investment portfolio

- Keeping cost low and having a diversified portfolio that is automatically re-balanced is required

I don’t need face to face advice right now

- You can speak to us about moving over to our Enhanced Partner Investment Service (EPIC) at any time

I’m financially literate

- You have a working knowledge of ISA’s and investments generally

I need to maximise my tax-breaks

- You recognise that using all of your tax allowances each year is important

- Access tax efficient investment products, quickly and easily online

- A complete guided service to help you find the right investment portfolio for your circumstances

- Minimum regular contributions from £100 per month and one off contributions from £1,000

- 10 risk-rated low cost passively managed investment portfolios

What’s involved?

We’ll ask some questions about your investment and the level of risk you’re comfortable with.

We’ll show how your money should be invested and provide projections for how it could perform.

This will usually take around 10 minutes. You can also save your progress half-way through.

This is entirely anonymous, until the point that you decide to make an investment.

What is an ISA?

ISAs are tax efficient savings accounts that allow you to invest in one or more of the investment portfolios available through our online investment service.

They are available for new investments by lump sums or regular monthly payment within limits set by the Government.

There are a number of different types of ISAs but you will only be able to invest in a Stocks and Shares ISA through our online investment service.

You can invest the full yearly ISA allowance for the current tax year as long as you have not used any of your ISA allowance elsewhere e.g. through Cash ISAs.

What is a General Investment Account (GIA)?

Investments can be held outside your ISA in our GIA product.

Unlike the ISA there are no limits to the amount you can hold in a GIA.

Unlike an ISA, growth within a GIA maybe subject to tax and you might be liable for Capital Gains Tax on encashment.