Wall of Worry!

A Timeline of Negative World Events

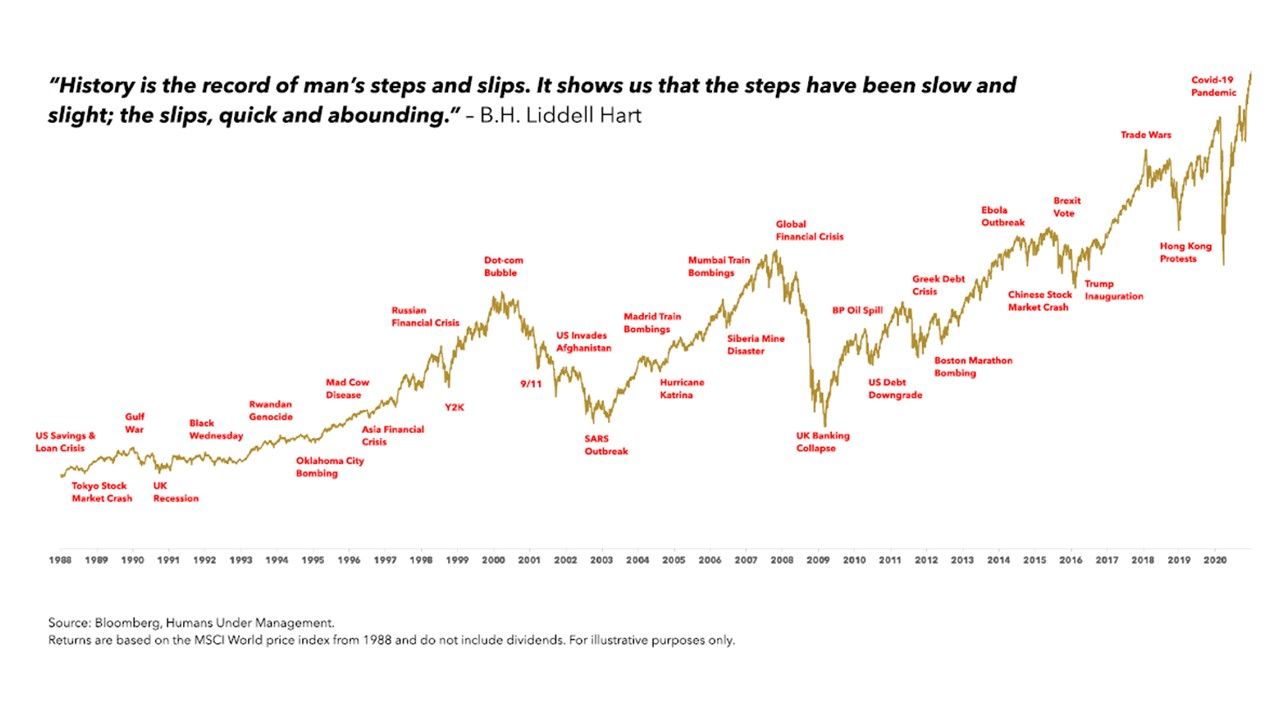

We have all been there, you wake up bright and early, head down for breakfast and open the paper or turn on your iPad and there it is, the stock markets seemingly heading south at a rapid rate.

What should you do? The main thing is not to panic because investing is a long-term activity and as shown below there has been long term growth in world equity markets, despite a never-ending stream of negative world events.

Despite ongoing uncertainty, £1 invested at the start of 1988 grew to £6.59 by the end of 2020. This is an average annual return of 5.88%.

Those of you who have been with Financial Planning Concepts for a long time will remember the shock of 2008 during the global financial crisis and the affect it had on your portfolios, but they recovered. And in early 2020, as well as learning that there was a virus at large which was a potential killer, the global markets plummeted giving everyone a significant shock and again your portfolios recovered relatively quickly. (*Between January to April 2020, the FTSE 100 index initially declined by 24%, our popular ‘Medium’ EPIC portfolio went down by 16%. By the end of 2020 EPIC finished the year around 19% higher than when it started, whereas the FTSE was still 12.5% below its starting level).

In summary the best thing to do when investing becomes scary is to hang in there and wait for the markets to recover, trust EPIC to do its job and look forward to future returns when the immediate shock has settled down.

Investment involves risk. The value of investments, and the income from them, can go down as well as up and you may get back less than the amount invested. Past performance is not a guide to future results. Annual management charges apply.

*Source – Clever adviser portfolios & MSCI UK Jan 2012 – Dec 2020

Recent Posts

-

22 August 2024

-

19 June 2023

-

12 April 2022

-

25 February 2022

-

17 January 2022

Archives

- August 2024

- June 2023

- April 2022

- February 2022

- January 2022

- November 2021

- September 2021

- February 2021

- August 2020

- June 2020

- January 2020

- August 2019

- July 2019

- June 2019

- November 2018

- September 2018

- July 2018

- June 2018

- April 2018

- August 2017

- May 2017

- April 2017

- February 2017

- July 2016

- June 2016

- May 2016

- March 2016

- November 2015

- September 2015

- May 2015

- January 2015

- November 2014