It’s the Climb – Why All-Time Highs Are Nothing to Fear

You might have seen headlines recently about the FTSE 100 hitting an “all-time high”. It’s been a strong year so far, with the UK market delivering double-digit returns – welcome news for investors.

But as markets rise, we often start hearing that familiar phrase: “the market is at its peak” – usually followed by a question like “is now the time to sell?”

It’s a natural reaction – all-time high sounds like something significant. Almost like the top of a mountain, with nowhere else to go but down.

But markets aren’t mountains.

Unlike a mountain climb that ends at the summit, investment markets are designed to keep rising over time. That’s the whole point of long-term investing – to grow your money as economies and companies grow.

So reaching a new high isn’t a warning sign. It’s a normal part of the journey.

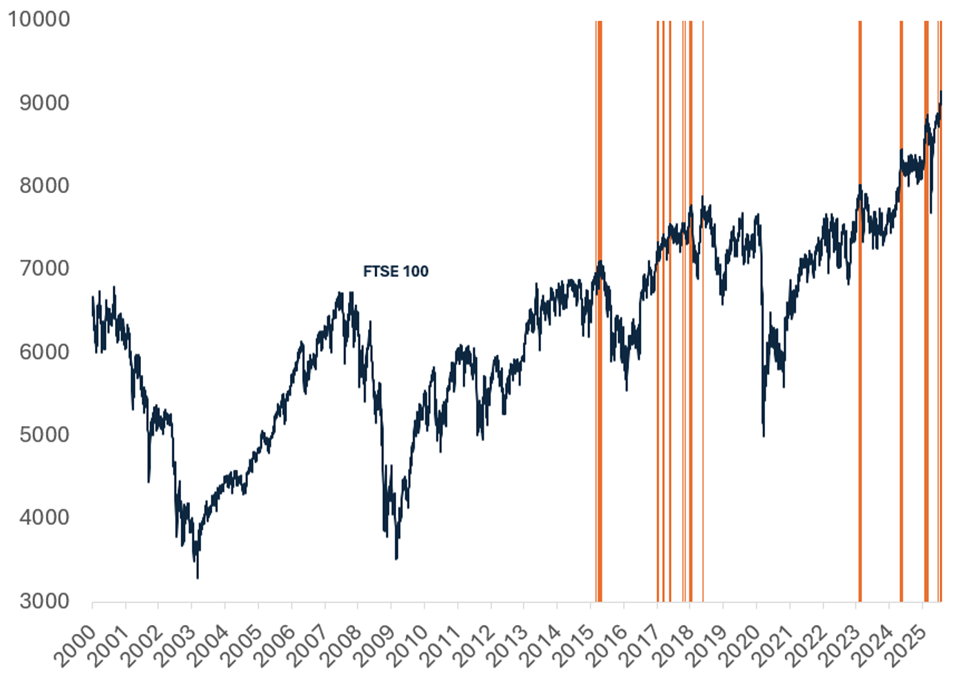

To illustrate this, let’s look at what’s happened since the dot-com crash back in 2000. The FTSE 100 didn’t get back to its previous high until 2015. But since then, it’s gone on to reach 84 new highs (the orange vertical lines – some of them are really close together), climbing over 30% in the process.

Source: 7IM/Factset. Past performance is not a guide to future returns.

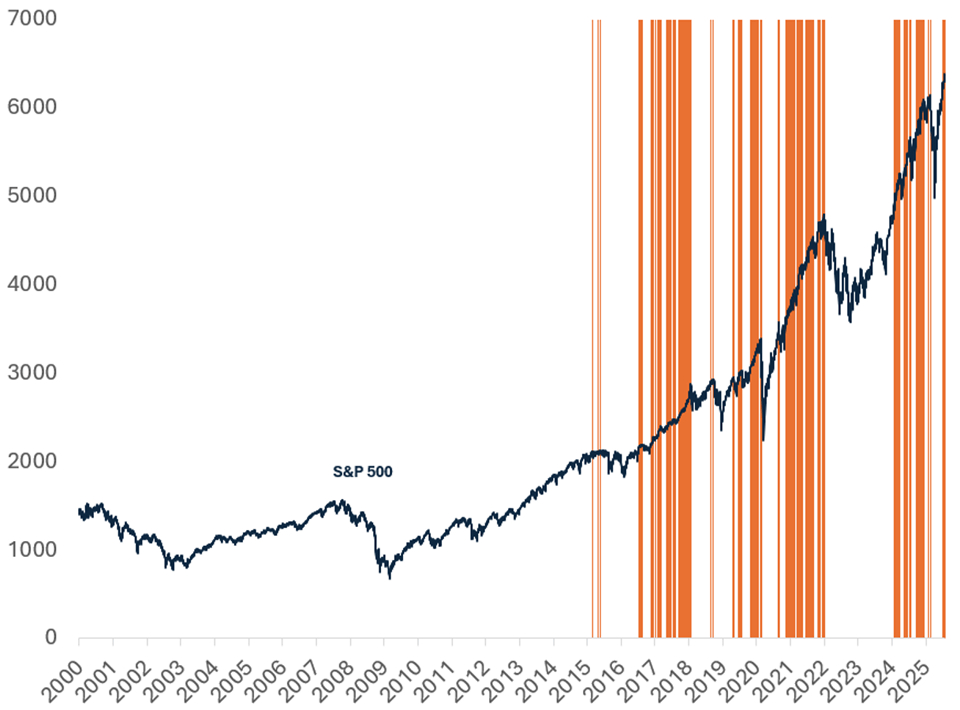

Even more striking, the US market has hit 315 new highs in the same period, delivering a return of nearly 200%.

Source: 7IM/Factset, Past Performance is not a guide to future returns.

And of course, it’s not just about the UK or the US. One of the key strengths of a well-diversified portfolio is that it doesn’t rely on any single region or sector. By spreading your investments across the globe – including Europe, Asia, emerging markets and beyond – we reduce the impact of short-term shocks in any one area. For example, today’s headlines around potential global tariffs proposed by President Trump have rattled markets and may well lead to a short-term dip. But this sort of movement is part and parcel of investing. Just as a few steps back on a walk don’t undo the entire journey, a down day in the markets doesn’t mean your long-term plan is off track.

The general direction of travel – if you stay invested and keep the faith – is upwards. That’s why we always focus on the long term, and why new highs should be welcomed, not feared.

Recent Posts

-

1 August 2025

-

22 August 2024

-

19 June 2023

-

12 April 2022

-

25 February 2022

Archives

- August 2025

- August 2024

- June 2023

- April 2022

- February 2022

- January 2022

- November 2021

- September 2021

- February 2021

- August 2020

- June 2020

- January 2020

- August 2019

- July 2019

- June 2019

- November 2018

- September 2018

- July 2018

- June 2018

- April 2018

- August 2017

- May 2017

- April 2017

- February 2017

- July 2016

- June 2016

- May 2016

- March 2016

- November 2015

- September 2015

- May 2015

- January 2015

- November 2014